This post is dated March 2015 and I am pleased to report that the process was successful, but not for the expected reasons.

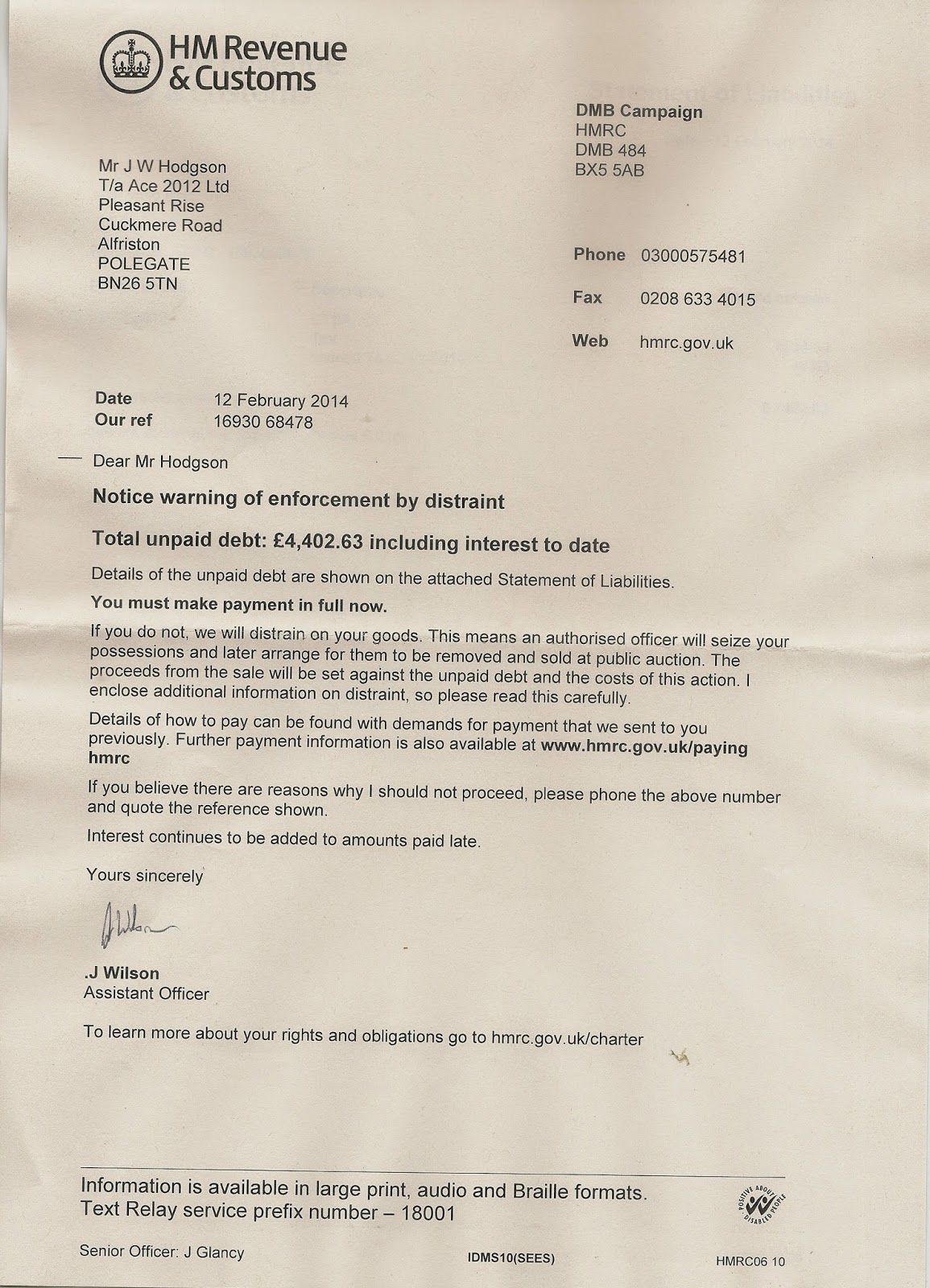

HMRC placed the debt in the hands of a debt collector. At this stage I had liquidated the company, ie paid out all its cash as a dividend to its shareholders.

After explaining to the debt collector, that the company has ceased trading and had no assets, they recommend that I ask for the company to be struck off.

So I logged into the company house registry website and requested that the company to be struck off the register. This took a little while, but the debt collector accepted this as a valid reason not to pursue the debt.

Hence - the company's tax bill was not "collected" by HMRC - it was paid by the bill of exchange, but this was not accepted by them. The reason for non collection was that the conaby had not funds and was struck off the register.

HMRC placed the debt in the hands of a debt collector. At this stage I had liquidated the company, ie paid out all its cash as a dividend to its shareholders.

After explaining to the debt collector, that the company has ceased trading and had no assets, they recommend that I ask for the company to be struck off.

So I logged into the company house registry website and requested that the company to be struck off the register. This took a little while, but the debt collector accepted this as a valid reason not to pursue the debt.

Hence - the company's tax bill was not "collected" by HMRC - it was paid by the bill of exchange, but this was not accepted by them. The reason for non collection was that the conaby had not funds and was struck off the register.